City Of Boulder Sales Tax Rate 2025

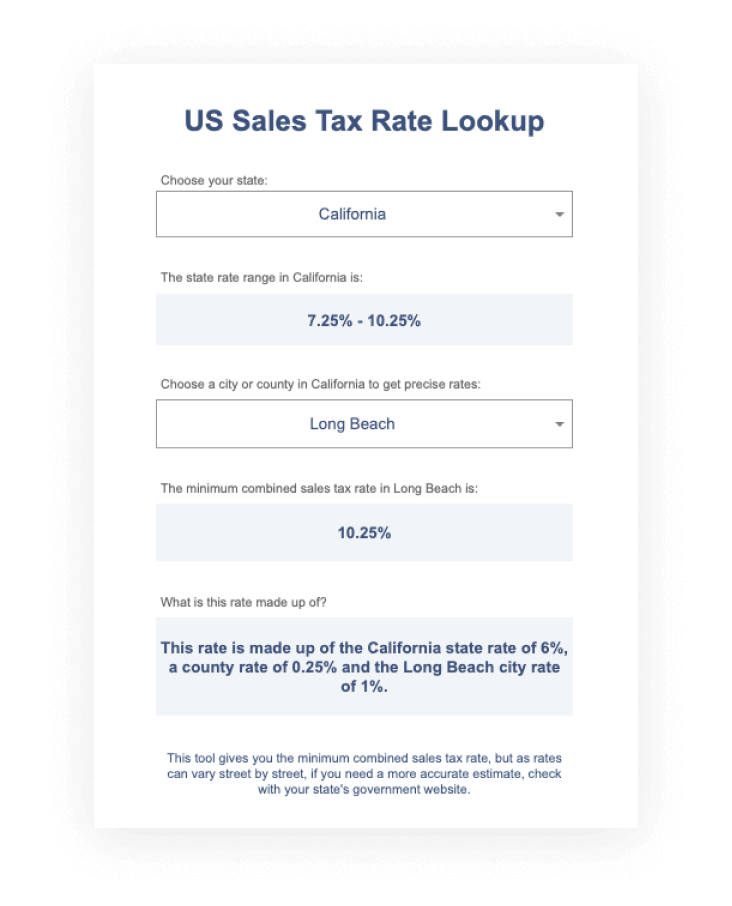

BlogCity Of Boulder Sales Tax Rate 2025. Colorado has state sales tax of 2.9% , and allows local governments to collect a local option sales tax of up to 8%. The average cumulative sales tax rate in boulder county, colorado is 8.17% with a range that spans from 5.19% to 9.44%.

The city use tax rate is the same as the sales tax rate: The 9.045% sales tax rate in boulder consists of 2.9% colorado state sales tax, 1.185% boulder county sales tax, 3.86% boulder tax and 1.1% special tax.

2025 Sales Tax Rates State & Local Sales Tax by State Tax Foundation, Boulder sales tax rates for 2025. With proof of payment, sales tax paid to another tax jurisdiction may be credited against consumer use tax due for a.

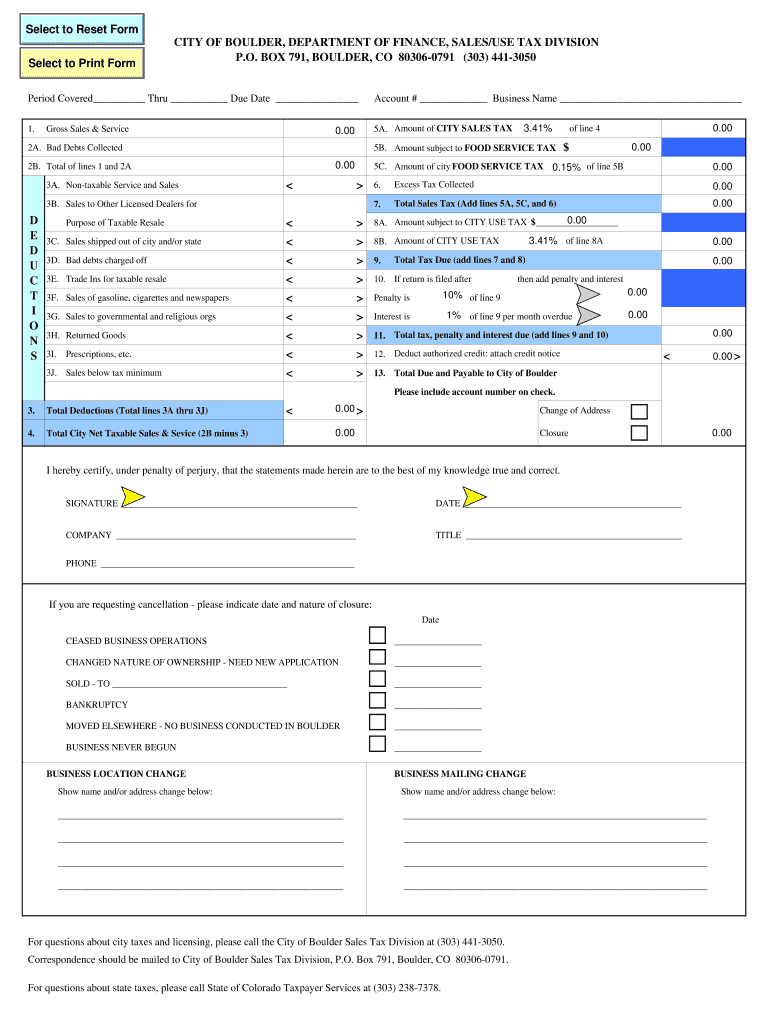

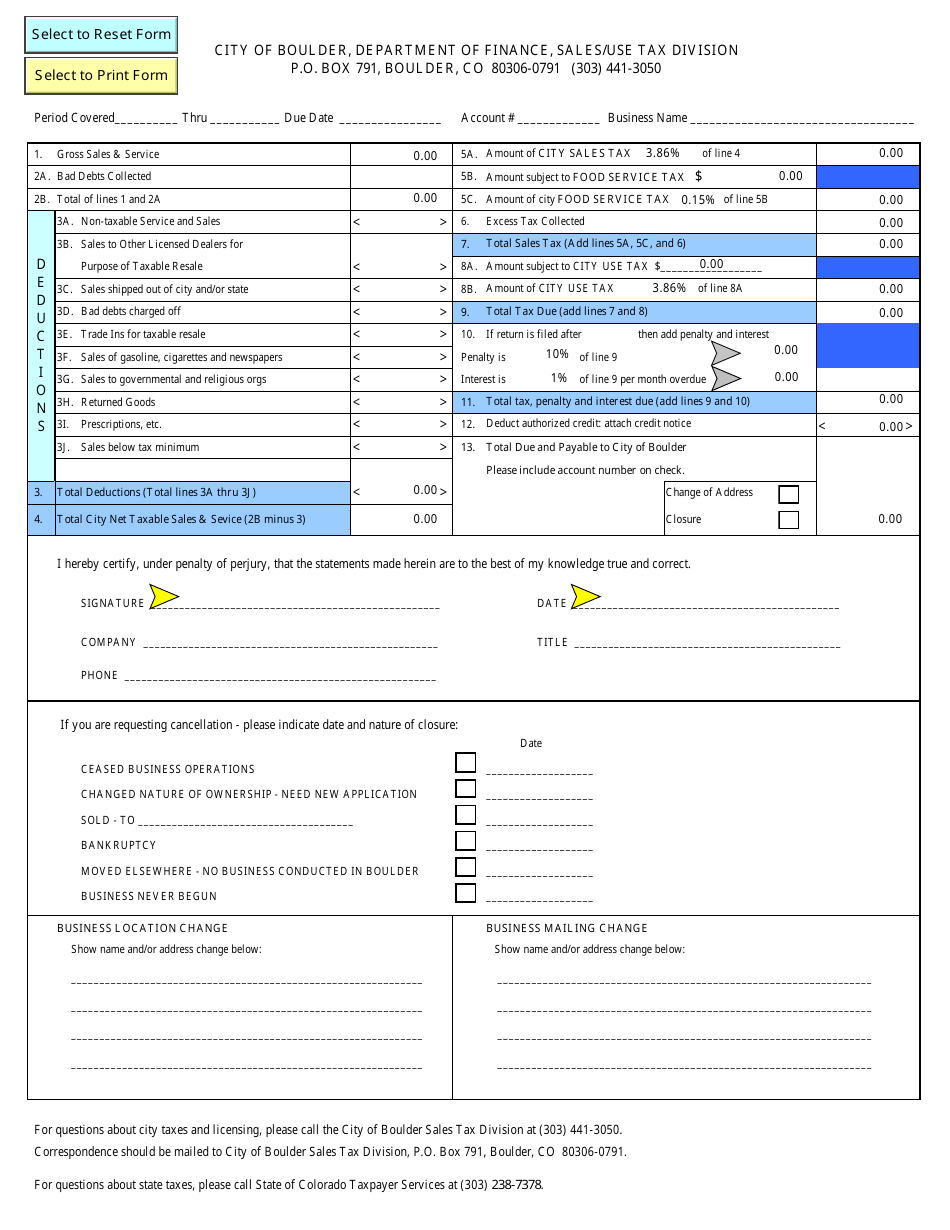

Sales Return Boulder Form Fill Out and Sign Printable PDF Template, The boulder, colorado sales tax is 8.85%, consisting of 2.90% colorado state sales tax and 5.95% boulder local sales taxes.the local sales tax consists of a 0.99% county sales tax,. The 9.045% sales tax rate in boulder consists of 2.9% colorado state sales tax, 1.185% boulder county sales tax, 3.86% boulder tax and 1.1% special tax.

Tax on sugarsweetened beverages Boulder, USA foodactioncities, The 2025 sales tax rate in boulder is 9.05%, and consists of 2.9% colorado state sales tax, 1.19% boulder county sales tax, 3.86% boulder city tax and 1.1% special district tax. Look up 2025 sales tax rates for boulder city, nevada, and surrounding areas.

Besteuerung Ihrer US Corporation Kanzlei Mount Bonnell, Tax rates are provided by avalara. There are a total of 276 local tax jurisdictions across the state,.

Business Licenses City of Boulder, The 2025 sales tax rate in boulder is 9.05%, and consists of 2.9% colorado state sales tax, 1.19% boulder county sales tax, 3.86% boulder city tax and 1.1% special district tax. The minimum combined 2025 sales tax rate for boulder county, colorado is.

Tax rates for the 2025 year of assessment Just One Lap, What is the sales tax rate in boulder county? Sales tax is due on all retail transactions in addition to any applicable city and state taxes.

boulder co sales tax vehicle Properties Ejournal Image Archive, The average cumulative sales tax rate in boulder, colorado is 9.05% with a range that spans from 9.05% to 9.06%. Every 2025 combined rates mentioned above are the results of colorado state rate.

USA GST rates explained Wise, How 2025 sales taxes are calculated for zip code 80302. Tax rates are provided by.

New York State Taxes What You Need To Know Russell Investments, Colorado has state sales tax of 2.9% , and allows local governments to collect a local option sales tax of up to 8%. Look up any boulder city tax rate and calculate tax based on address.

Taxes City of OKC, Boulder county’s sales tax rate is 1.185% for 2025. The boulder, colorado sales tax is 8.85%, consisting of 2.90% colorado state sales tax and 5.95% boulder local sales taxes.the local sales tax consists of a 0.99% county sales tax,.